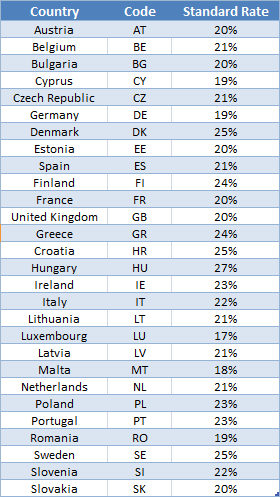

The eu sets the broad vat rules through european vat directives and has set the minimum standard vat rate at 15. This enables them to keep special rates reduced rates under 5 including zero rates and reduced rates for goods and services other than those listed in the directive articles 102 128 vat directive.

Woocommerce Setup For Eu Vat Rates For Digital Products Tutorial

Woocommerce Setup For Eu Vat Rates For Digital Products Tutorial

The eus institutions do not collect the tax but eu member states are each required to adopt a value added tax that complies with the eu vat code.

Eu vat rates. The eu has standard rules on vat but these rules may be applied differently in each eu country. Und damit e commerce unternehmen zukunftig nicht mehr in lander ausserhalb der europaischen union fliehen um so der abgabe der umsatzsteuer zu entgehen wurde diese entsprechende regelung eu weit getroffen. Your refund will likely be less than the rate listed above especially if its subject to processing fees.

The eu also permits a maximum of two reduced rates the lowest of which must be 5 or above. Some countries have variations on this including a third reduced vat rate which they had in place prior to their accession to the eu. When discussing eu vat rates there are going to be plenty of variations across the continent since nations have their separate rules and regulations for the treatment of goods and services.

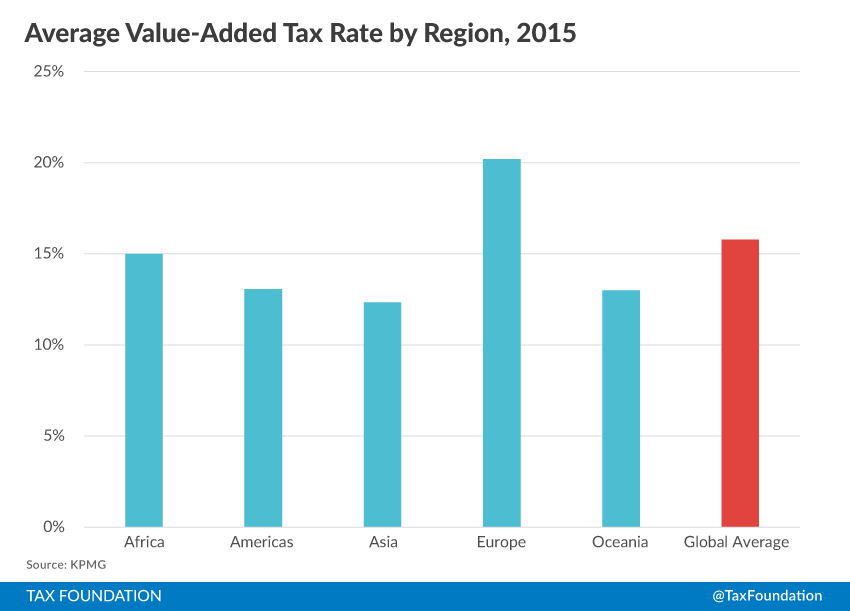

More than 140 countries worldwide including a! ll european countries levy a value added tax vat on purchases ! for consumption. Einmal mehr soll steuergerechtigkeit geschaffen werden. You must normally pay vat on all goods and services up to and including the sale to the final consumer.

Different rates of vat apply in different eu member states ranging from 17 in luxembourg to 27 in hungary. The 28 member states are otherwise free to set their standard vat rates. As todays tax map shows although harmonized to some extent by the european union eu europes vat rates vary moderately across countries.

Eu vat standard rates are set by member countries and can fluctuate. Eu countries have flexibility about what vat rates they implement however the lowest standard rate that can be applied is 15. Your refund will likely be less than the rate listed above especially if its subject to processing fees.

Home vat tables eu vat rates. Within the principal eu vat directive articles exist which dictate that eu member states must apply! a standard rate of vat within a particular range and may also choose to apply a reduced vat rate no lower than 5 although certain eu member states may have derogations from this which allows a lower percentage.

Vat Rates On Medicine In Europe By Country 2018 Pharmaboardroom

Vat Rates On Medicine In Europe By Country 2018 Pharmaboardroom

Vat Rates

Vat Rates

European Union Value Added Tax Wikipedia

European Union Value Added Tax Wikipedia

Tourism Related Taxes Across The Eu Internal Market Industry

Tourism Related Taxes Across The Eu Internal Market Industry

What Are The Eu Vat Rates Vat4u

What Are The Eu Vat Rates Vat4u

Vat In Europe Online Collection Ibfd

Vat In Europe Online Collection Ibfd

Proposal Vat Rates Taxation And Customs Union

Proposal Vat Rates Taxation And Customs Union

Vat Api Eu Vat Rates Number Validation Compliant Invoicing Api

Vat Api Eu Vat Rates Number Validation Compliant Invoicing Api

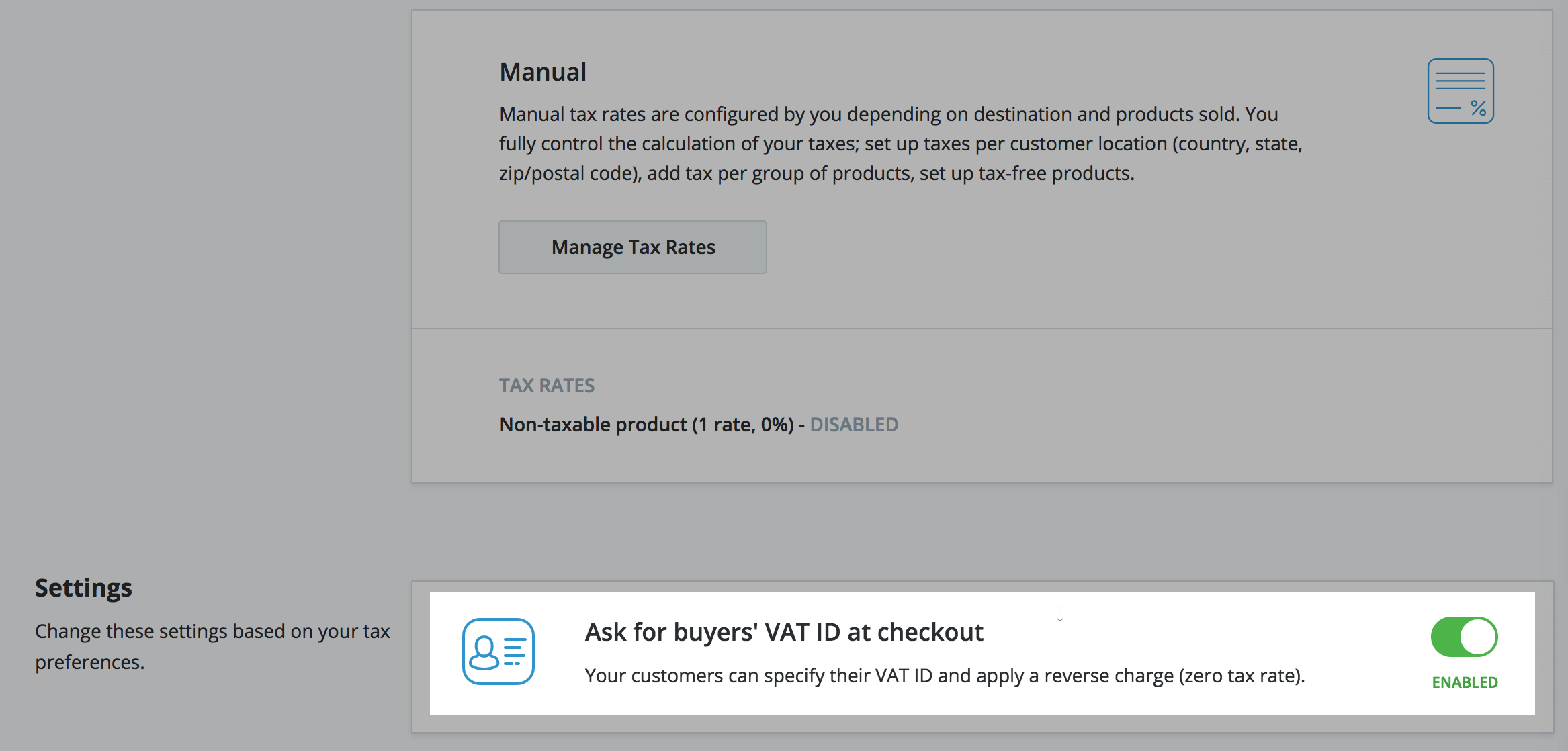

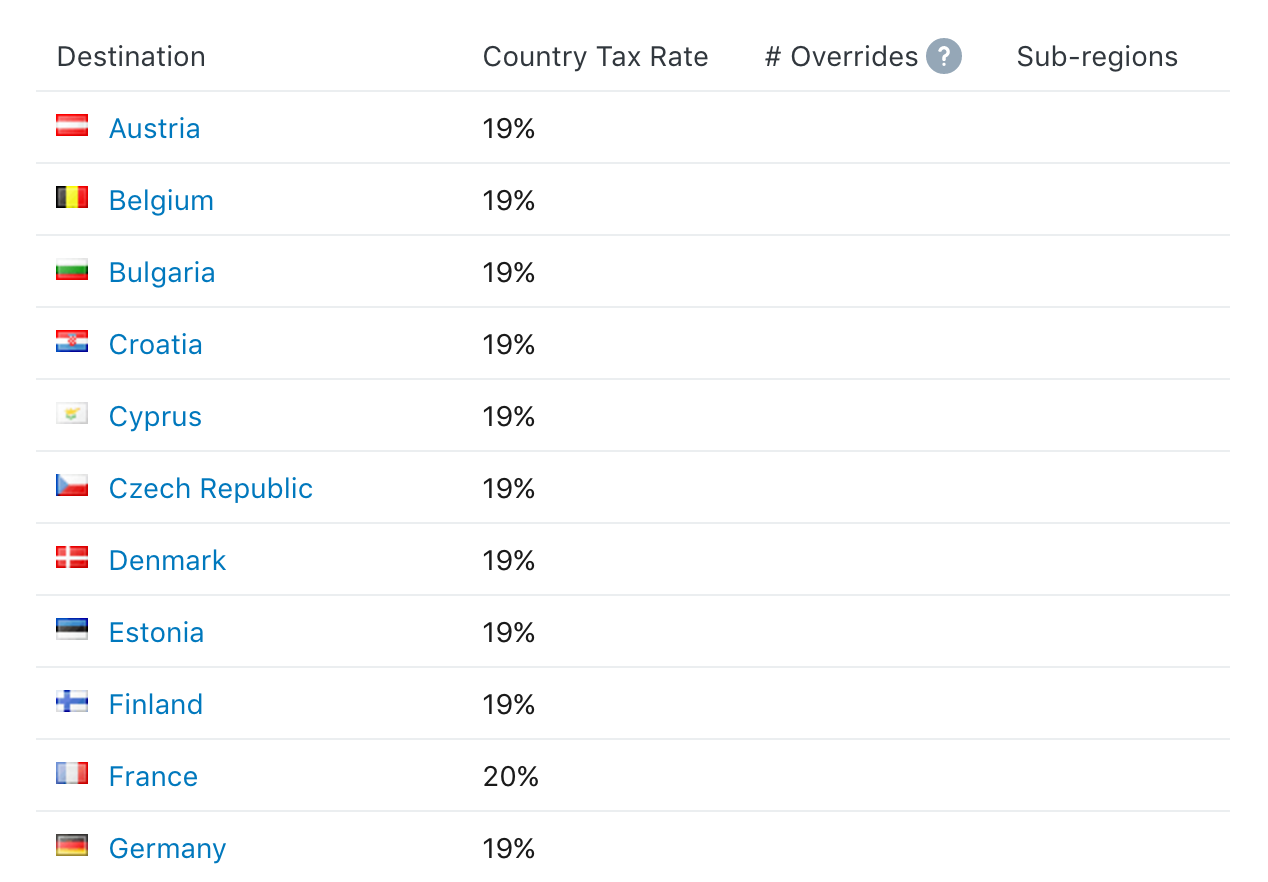

Setting Up Eu Vat Rates For Digital Products Woocommerce Docs

Setting Up Eu Vat Rates For Digital Products Woocommerce Docs

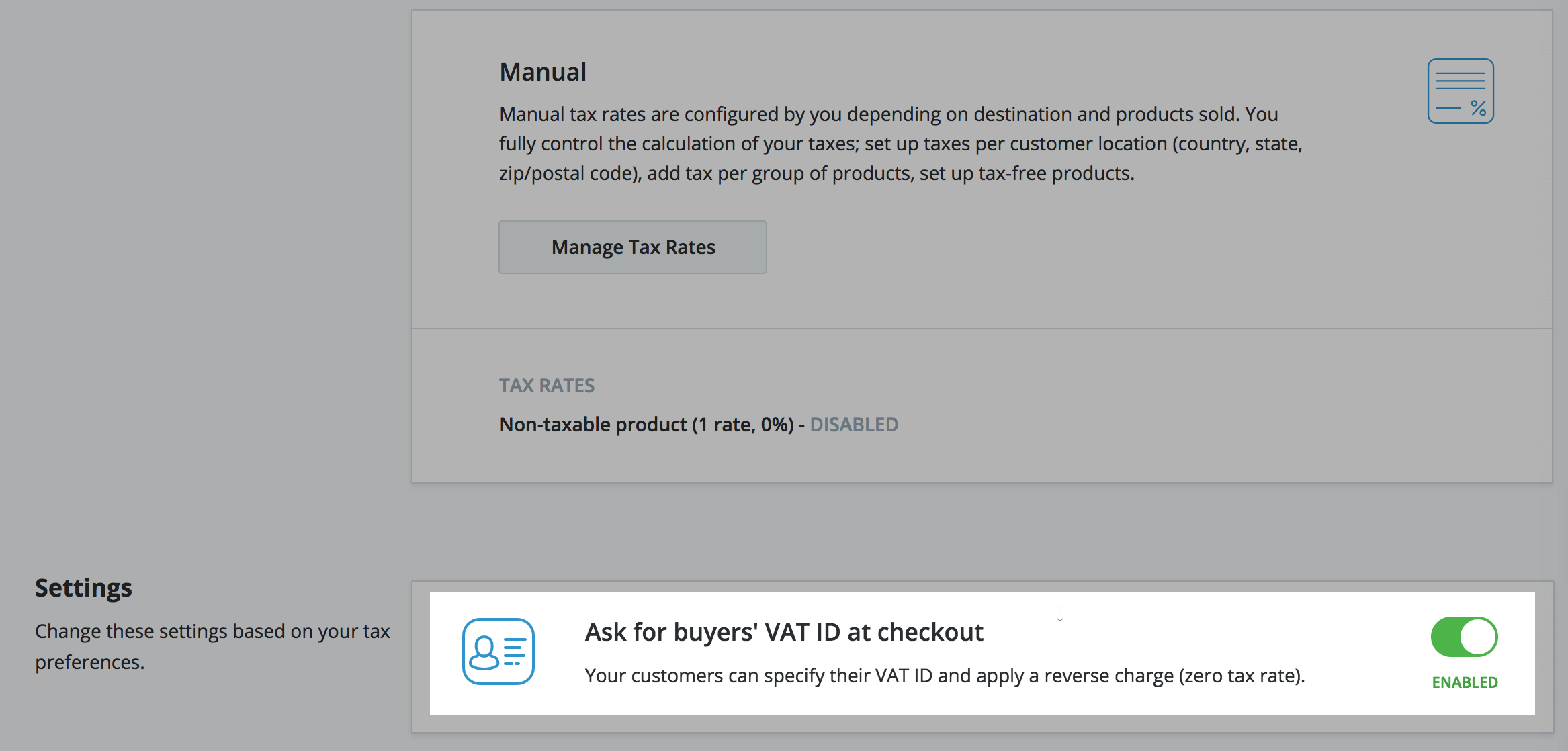

Set Up Eu Taxes In Your Shopify Store Sufio For Shopify

Set Up Eu Taxes In Your Shopify Store Sufio For Shopify

Woocommerce Eu Vat Compliance Assistant Wordpress Plugin

Woocommerce Eu Vat Compliance Assistant Wordpress Plugin

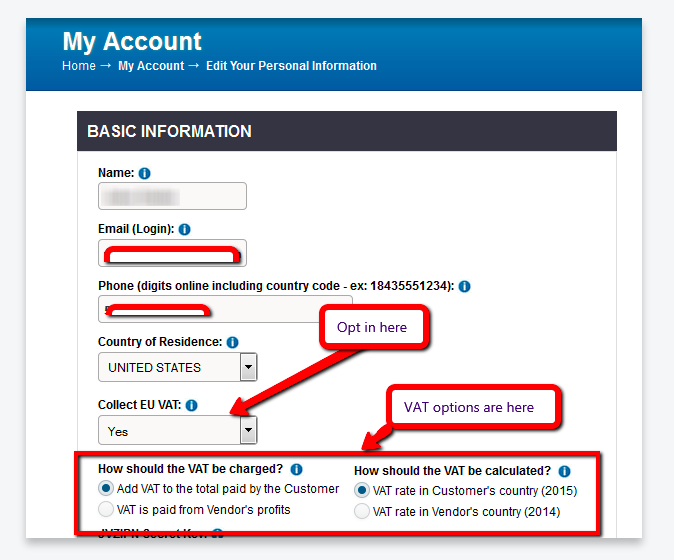

Information On Setting Up And Collecting Vat Jvzoo

Information On Setting Up And Collecting Vat Jvzoo

Eu Vat Rates 2019 Third Party Add Ons Whmcs Community

Eu Vat Rates 2019 Third Party Add Ons Whmcs Community

How Many Countries In The World Have A Value Added Tax Tax Foundation

How Many Countries In The World Have A Value Added Tax Tax Foundation

S! etting Up Eu Value Added Tax Vat Online Store

S! etting Up Eu Value Added Tax Vat Online Store

0 Response to "Eu Vat Rates"

Posting Komentar